The 82nd International Atlantic Economic Conference held in Washington D.C., October 13-16, 2016 brought together economists and finance experts from all around the world to discuss the economic issues of the past, present and future. This year’s conference featured an amazing group of presenters, including Dr. Lawrence Christiano who gave the 2016 William S. Vickrey Distinguished Address. If you attended the conference or you are curious about what you missed follow the links below to view photos taken throughout the conference and videos of the highlighted events. Special thanks to all who attended!

- Please click HERE to view the Washington D.C. web program.

- Please click HERE to view the Washington D.C. photos.

Highlights Included:

Lawrence Christiano, 2016 William S. Vickrey Distinguished Address:

“The Great Recession of 2008: An Earthquake in Macroeconomics”

Dr. Lawrence Christiano is the Alfred W. Chase Chair of Business Institutions at Northwestern University, Research Associate, National Bureau of Economic Research, and Fellow of the Econometric Society. His research has focused on macroeconomic theory, policy, and econometrics. Christiano’s work has been published in numerous journals, including the Journal of Economic Theory, the American Economic Review, and the Review of Economics and Statistics. He was Director of the Institute for Empirical Macroeconomics at the Federal Reserve Bank of Minneapolis, and has served as a research consultant for the Fed’s Board of Governors and the Federal Reserve Banks of Cleveland, Chicago, and Atlanta.

Joel Mokyr, Presidential Address:

“Is Technological Change a Matter of the Past?”

Joel Mokyr is the Robert H. Strotz Professor of Arts and Sciences and Professor of Economics and History at Northwestern University and a Raymond and Beverly Sackler Senior Professor by special appointment at Tel Aviv University’s Eitan Berglas School of Economics. He is an expert on the economic history of Europe, specializing in 1750-1914, and has published over 80 articles and books. He has served as editor in chief of the book series, Economic History of the Western World. His books have won honors including the Joseph Schumpeter Memorial Prize (1990), the Ranki Prize for best book in European Economic history and more recently the Donald Price Prize of the American Political Science Association.

“Institutions and the Persistence of Western Economic Growth: The Legacy of Douglas C. North” Plenary Symposium:

Chair and Organizer: Joel Mokyr, Northwestern University

Jack A. Goldstone is the Virginia E. and John T. Hazel Professor of Public Policy, George Mason University, and non-resident Senior Fellow, Brookings Institution. His book, Revolution and Rebellion in the Early Modern World, was awarded the 1993 Distinguished Scholarly Research Award by the American Sociological Association. His current research focuses on conditions for building democracy and stability in developing nations, the impact of population change on the global economy and international security, and cultural origins of modern economic growth.

Jack A. Goldstone is the Virginia E. and John T. Hazel Professor of Public Policy, George Mason University, and non-resident Senior Fellow, Brookings Institution. His book, Revolution and Rebellion in the Early Modern World, was awarded the 1993 Distinguished Scholarly Research Award by the American Sociological Association. His current research focuses on conditions for building democracy and stability in developing nations, the impact of population change on the global economy and international security, and cultural origins of modern economic growth.

Noel Johnson is Research Fellow at the Mercatus Center, Associate Professor of Economics at George Mason University and faculty member, Center for the Study of Public Choice. His research interests include economic history, new institutional economics and cultural economics, focusing on historical origins of modern economic growth. He is interested in how current political and cultural institutions have evolved and whether they impede or facilitate economic success. His latest book co-authored with M. Koyama entitled Persecution & Toleration: The Long Road to Religious Freedom will be published in 2017.

Noel Johnson is Research Fellow at the Mercatus Center, Associate Professor of Economics at George Mason University and faculty member, Center for the Study of Public Choice. His research interests include economic history, new institutional economics and cultural economics, focusing on historical origins of modern economic growth. He is interested in how current political and cultural institutions have evolved and whether they impede or facilitate economic success. His latest book co-authored with M. Koyama entitled Persecution & Toleration: The Long Road to Religious Freedom will be published in 2017.

Joel Mokyr is Professor of Economics and History at Northwestern University. He has been President of the Economic History Association, Editor-in-Chief of the Oxford Encyclopedia of Economic History, a co-editor of the Journal of Economic History, and is currently President of the International Atlantic Economic Society. He was the 2006 winner of the biennial Heineken Award for History offered by the Royal Dutch Academy of Sciences and winner of the 2015 Balzan International Prize for economic history. His latest book is, A Culture of Growth: Origins of the Modern Economy, to be published by Princeton University Press in 2016.

Joel Mokyr is Professor of Economics and History at Northwestern University. He has been President of the Economic History Association, Editor-in-Chief of the Oxford Encyclopedia of Economic History, a co-editor of the Journal of Economic History, and is currently President of the International Atlantic Economic Society. He was the 2006 winner of the biennial Heineken Award for History offered by the Royal Dutch Academy of Sciences and winner of the 2015 Balzan International Prize for economic history. His latest book is, A Culture of Growth: Origins of the Modern Economy, to be published by Princeton University Press in 2016.

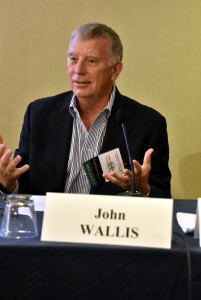

John Wallis is Professor of Economics at University of Maryland and a Research Associate at the National Bureau of Economic Research. He is an economic historian who specializes in the study of public finance in American government, constitutional development, and more generally on the institutional development of governments and economies. Throughout his career, most of his work has focused on American history, but over the last decade he has begun work on contemporary development problems around the world. His areas of interests include political economics, development economics, political science, sociology, and cognitive psychology.

John Wallis is Professor of Economics at University of Maryland and a Research Associate at the National Bureau of Economic Research. He is an economic historian who specializes in the study of public finance in American government, constitutional development, and more generally on the institutional development of governments and economies. Throughout his career, most of his work has focused on American history, but over the last decade he has begun work on contemporary development problems around the world. His areas of interests include political economics, development economics, political science, sociology, and cognitive psychology.

“Financial Regulations Six Years After Dodd-Frank: Where Do We Go From Here” Plenary Symposium:

Organizer: Christine Cumming, Rutgers University

Chair: Richard Herring, Wharton School

Charles Calomiris is Henry Kaufman Professor of Financial Institutions at the Columbia University Graduate School of Business, Professor at Columbia’s School of International and Public Affairs, and immediate past President of the International Atlantic Economic Society. He is a member of the Shadow Open Market Committee and the Financial Economists Roundtable, and a Research Associate of the National Bureau of Economic Research. Charlie holds a Ph.D. in economics from Stanford University. His research spans several areas, including banking, corporate finance, financial history, and monetary economics.

“Prudential Financial Regulations that Work”

Robert Eisenbeis is Cumberland Advisors’ Chief Monetary Economist. He was formerly Executive Vice-President and Director of Research at the Federal Reserve Bank of Atlanta. He is currently a member of the Shadow Financial Regulatory Committee and Financial Economist Roundtable, the National Association of Business Economists and Wharton Financial Institutions Center. He holds a Ph.D. from Princeton University and has authored over 100 articles, monographs and books on financial regulation, international finance, and international banking.

“Goal Conflicts and Financial Stability”

Beverly Hirtle is Senior Vice President in the Research and Statistics Group at the Federal Reserve Bank of New York. Her research focuses on risk management, disclosure, and market structure and performance issues in the U.S. banking industry. Recent papers have focused on retail banking and branching activity, banks’ public disclosures and transparency, and stock repurchase activity. She has worked extensively on issues related to the Basel Accord’s treatment of market, credit, and operational risk, and on financial stability issues.

“Supervisory Stress Test Disclosures: Motivation and Impact”

Til Schuermann is Partner in the Finance and Risk, and Public Policy practices at Oliver Wyman & Company. Previously he was Senior Vice President, Federal Reserve Bank of New York. In 2009, he helped lead and design the Supervisory Capital Assessment Program, and Comprehensive Capital Analysis and Review programs. In 2008, Til led a team assessing capital and liquidity adequacy of four large U.S. investment banks. He developed and executed liquidity stress tests, per the Valukas report. His current research focus is stress testing, capital planning, enterprise-wide risk management and corporate governance.

“Stress Testing: The Post-Crisis Elixir of Regulators”

“Big Banks: Ensuring Safety and Soundness” Session:

Chair: Julpa Jagtiani, Federal Reserve Bank of Philadelphia, U.S.A.

Charles Calomiris is Henry Kaufman Professor of Financial Institutions at the Columbia University Graduate School of Business, Professor at Columbia’s School of International and Public Affairs, and immediate past President of the International Atlantic Economic Society. He is a member of the Shadow Open Market Committee and the Financial Economists Roundtable, and a Research Associate of the National Bureau of Economic Research. His research spans several areas, including banking, corporate finance, financial history, and monetary economics.

“A Theory of Bank Liquidity Requirements”

“Will the Requirements for Total Loss Absorbing Capacity Solve Too Big To Fail?”

Richard Herring is Jacob Safra Professor of International Banking and Professor of Finance at The Wharton School, University of Pennsylvania. He is also director of the Joseph H. Lauder Institute of Management and Co-Director of the Wharton Financial Institutions Center. He is Co-Chair of the U.S. Shadow Financial Regulatory Committee, Executive Director of the Financial Economists Roundtable, and a member of the Federal Deposit Insurance Corporation Systemic Risk Advisory Committee. He has authored more than 100 articles, monographs and books.

“The Evolving Complexity of Capital Regulation”

Christine Cumming recently joined the faculty in the Economics department at Rutgers University, after her retirement as first vice president of the Federal Reserve Bank of New York. There she was the second ranking officer in the Bank, and serves as its chief operating officer, as well as an alternate voting member of the Federal Open Market Committee. Prior to being named Vice President Dr. Cumming was executive vice president and director of research with responsibility for the Research and Market Analysis Group. She assumed these responsibilities in September 1999.

“A Heuristic View of Evolving Capital and Liquidity Standards”

Joseph P. Hughes is Professor of Economics at Rutgers University. His research has been published in such journals as the American Economic Review, the Journal of Banking and Finance, the Journal of Economic Theory, the Journal of Financial Services Research, the Journal of Money, Credit, and Banking, and the Review of Economics and Statistics. He has been a Visiting Scholar at the Office of the Comptroller of the Currency, the Federal Reserve Bank of Philadelphia, and the Federal Reserve Bank of New York. He is also a past President of the International Atlantic Economic Society.

“Capital Regulation: Less Really Can Be More When Incentives are Socially Aligned”

Edward J. Kane is Professor of Finance at Boston College and a longtime Research Associate of the National Bureau of Economic Research. He is also founding member of the Shadow Financial Regulatory Committee, a senior fellow in the Federal Deposit Insurance Corporation’s Center for Financial Research, and consults for the World Bank. He is former President of the International Atlantic Economic Society (2004-2005) and currently serves on six editorial boards, including the Atlantic Economic Journal. He holds a Ph.D. from Massachusetts Institute of Technology, authored three books, is widely published in professional journals.

“Can Anything Ever End Too Big To Fail?”

Best Article Award Presentations:

2015 Winners: Ahmad H. Ahmad Loughborough University, U.K.,

and Su-Ling Fanelli University of Bath, U.K.

“Fiscal sustainability in the Euro-Zone: Is There A Role for Euro-Bonds?”

2016 Winners: Gil Kim California State University-Fresno, U.S.A., Lian An University of Kentucky, U.S.A., and Yoonbai Kim University of North Florida, U.S.A.

“Exchange Rate, Capital Flow, and Output: Developed versus Developing Economies”

Best Undergraduate Paper Competition Winner and Finalists:

Winner:

Adam Brzezinski, University of Warwick, Synergies in labor market institutions: The nonlinear effect of minimum wages on youth employment View Presentation

Finalists:

Grace Elizabeth Finley, University of Virginia, Nongovernmental organizations in

Bangladesh: Platforms in a two-sided market

Rachel Philbin, University of Pennsylvania, People following goods: Are refugee flows associated with international trade? View Presentation

Ryan Zalla, Villanova University, Economic policy uncertainty in Ireland View Presentation